Life is full of surprises, and while we cannot always predict what will happen tomorrow, we can take steps to prepare for unexpected events. One of the most common ways people prepare is by choosing a life insurance policy. For many, life insurance may sound complicated, filled with terms that seem difficult to understand. But when you break it down into simple words, life insurance is really just a way to take care of the people you love. It is about making sure your family will have support if something ever happens to you. This guide is designed to explain life insurance in a friendly, easy-to-follow manner so that anyone can understand the basics, the choices available, and the benefits of having coverage.

At its core, life insurance is an agreement between a person and an insurance company. You agree to pay a certain amount of money on a regular basis, called a premium. In return, the insurance company agrees to pay your chosen loved ones, called beneficiaries, a set amount of money, called a death benefit, if you pass away while the policy is active. This benefit is not about making anyone wealthy. It is about giving your family a financial safety net so they are not left struggling with bills, debts, or important needs during a difficult time. In this way, life insurance is an expression of care and responsibility.

There are many reasons why people choose to get life insurance. Parents often consider it because they want to protect their children and spouse. If someone has a mortgage or student loans, a life insurance policy can help ensure those debts are not passed on to loved ones. Others purchase it so that their children can continue their education no matter what happens. Some people simply want peace of mind, knowing that their family will be supported even in the face of unexpected events.

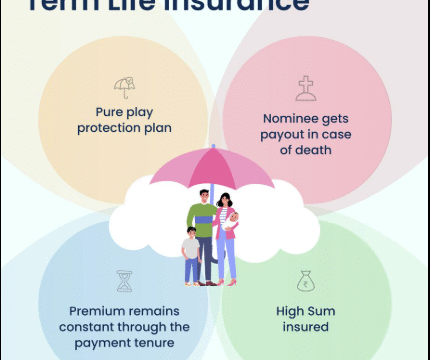

Life insurance policies generally fall into two main categories: term life insurance and permanent life insurance. Term life insurance is straightforward. It covers you for a specific period of time, such as 10, 20, or 30 years. If something happens to you during that time, the policy pays out the death benefit. If you outlive the term, the policy ends, although some can be renewed. Many families like term life insurance because it is usually simpler and more affordable compared to other types. Permanent life insurance, on the other hand, lasts for your entire lifetime as long as you keep paying the premiums. These policies also often include a feature called cash value, which works like a small savings account that grows over time. Permanent life insurance can be more complex and typically costs more, but some people like the fact that it provides lifelong coverage.

Within these categories are different variations. Whole life insurance is a type of permanent policy that offers lifetime coverage with fixed premiums and a guaranteed benefit. Universal life insurance provides more flexibility, letting you adjust your premiums or benefits over time. Variable life insurance includes investment options alongside the death benefit, although it is more complex and carries more risk. Group life insurance is often offered through employers, giving employees a basic level of coverage as part of their workplace benefits.

When reading about policies, you will see certain key terms. Premium is the payment you make to keep the policy active. Death benefit is the amount your loved ones receive. Beneficiaries are the people you name to receive the benefit. Cash value, when included, is a savings feature in permanent policies. Policy term refers to the length of coverage in a term life insurance plan. Once you understand these words, life insurance becomes much easier to follow.

Choosing a policy depends on your personal situation. Start by asking yourself some simple questions. How many people depend on your income? Do you have debts such as a mortgage or car loan that would be difficult for your family to cover without you? How long do you want coverage to last—just while your children are young, or for your entire lifetime? Do you prefer something simple and affordable, or something long-term that comes with additional features? What monthly premium amount would comfortably fit into your budget? These questions can guide you toward the type of policy that makes sense for your needs.

It may also help to picture everyday examples. A young couple with a new baby might choose a 20-year term life policy so that if something happens, the child will have financial support until adulthood. A single parent might choose a policy that covers enough to pay for school tuition and housing. An older couple may prefer a permanent policy so they can leave something behind for their grandchildren. In each case, the choice reflects a personal goal rather than a complicated financial strategy.

Life insurance also provides benefits beyond money. It gives peace of mind. Knowing that your family will not have to worry about bills in the middle of grief is a powerful reassurance. It can also provide a sense of dignity, ensuring that loved ones can focus on healing rather than scrambling for resources. For many, this emotional security is just as valuable as the financial support.

There are also many misconceptions about life insurance. One common myth is that it is only for older people, when in fact many young families benefit greatly from coverage, and premiums are usually lower at younger ages. Another misconception is that life insurance is too expensive. While some policies can be costly, many affordable options exist, especially with term life coverage. Some people believe they don’t need it if they are healthy, but health can change unexpectedly. Others assume that coverage provided through their job is enough, but employer policies often only cover a fraction of what a family might actually need.

To make life insurance simple, take it step by step. Learn the basics first, without worrying about every small detail. Think about your family’s biggest financial needs. Compare a few different types of policies to see what feels right. Choose a coverage amount that is realistic for your budget. Review your policy from time to time as your life changes, because needs often shift when you buy a home, get married, or welcome children.

In today’s world, life insurance is also becoming more digital. Many companies now offer online applications, digital calculators to help estimate how much coverage you may want, and mobile apps to manage policies. This makes life insurance easier to understand and more accessible to younger generations who prefer digital solutions. Looking ahead, policies will likely become even more personalized, with digital platforms that guide families step by step through the process.

In conclusion, life insurance may sound complicated at first, but it is really about something very simple: caring for the people who matter most. It is about offering security, stability, and peace of mind. Whether you choose a short-term policy to protect your family during important years or a permanent policy that provides lifelong coverage, the goal is the same—to prepare with love and responsibility. By breaking down the basics, asking yourself a few guiding questions, and exploring the options, anyone can feel confident about life insurance. It is not about predicting the future but about protecting it, so your family can continue moving forward with strength and support.