Home is more than just a building. It is the place where you feel safe, where family memories are created, and often your most valuable financial investment. Protecting that home is essential, and that is why home insurance policies exist. A home insurance policy provides financial protection against many unexpected risks such as fire, theft, storms, or accidents that cause damage to your house and belongings. It can also protect you from liability if someone is injured on your property.

Many people first encounter home insurance because lenders usually require it when approving a mortgage. Even if it is not mandatory, having home insurance is a smart way to protect both your property and your finances. To make the most of it, homeowners need to understand the basics—what it covers, what it excludes, how premiums are calculated, and how to select the right policy for their situation.

What Is Home Insurance?

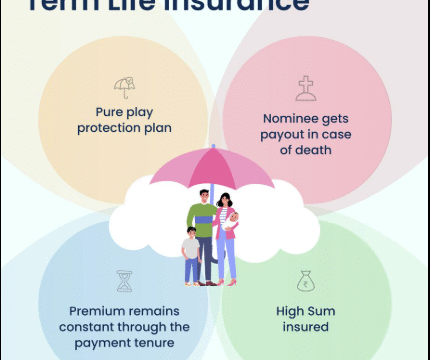

Home insurance, often called homeowners insurance, is a contract between you and an insurance company. You agree to pay a premium, and in return, the insurer promises to cover certain losses and damages related to your home, your personal belongings, or liability situations. The policy is usually summarized on a declarations page that outlines your coverage limits, deductibles, and the specific protections included.

Unlike auto insurance, which is often required by law, home insurance is not legally mandatory in most places. However, since a home is such a valuable asset, it is almost always encouraged and in many cases required by mortgage lenders.

Why Home Insurance Matters

The importance of home insurance cannot be overstated. Without it, a single disaster could cost you tens or even hundreds of thousands of dollars. Imagine a fire destroying your kitchen, or a burglary that takes away your electronics and jewelry. With a proper policy, you can file a claim and get financial help to rebuild, repair, or replace. Without one, you would be paying out of pocket.

Home insurance not only covers physical property but also provides peace of mind. It allows you to focus on enjoying your home, knowing you are financially prepared for unexpected problems.

The Main Components of a Home Insurance Policy

Most home insurance policies are designed to cover four main areas, with some additional benefits included.

Dwelling Coverage

This protects the structure of your home itself, including walls, floors, roof, built-in appliances, and attached structures like decks or garages. If a fire or storm damages your house, dwelling coverage pays for repair or rebuilding.

Other Structures Coverage

Many homes have separate structures such as detached garages, fences, or storage sheds. These are also protected but usually at a lower percentage of the main dwelling coverage.

Personal Property Coverage

This section protects your belongings, such as furniture, clothes, electronics, and appliances. If they are stolen, damaged, or destroyed by a covered event, the insurance reimburses you. Some policies also cover belongings outside your home, for instance items stolen from your car.

Liability Protection

If someone slips and falls in your driveway or is injured by your dog, liability coverage helps protect you financially. It covers medical expenses and even legal fees if you are sued.

Additional Living Expenses

If a disaster makes your home unlivable, your policy can cover temporary housing, food, and other necessary expenses until repairs are completed.

Common Risks Covered by Home Insurance

Most policies include protection against risks such as fire and smoke damage, theft, vandalism, windstorms, hail, lightning strikes, falling objects, water damage from plumbing issues, and explosions. A comprehensive policy provides broader coverage, protecting against many types of unexpected events unless specifically excluded.

What Is Not Covered by Standard Policies

It is just as important to understand what home insurance does not cover. Standard exclusions often include floods, earthquakes, wear and tear, pest damage, sewer backups, and acts of war. If you live in a flood-prone or earthquake-prone area, you will usually need to purchase a separate policy.

How Premiums Are Calculated

The cost of home insurance is influenced by many factors. These include your home’s location, the cost to rebuild it, the age and condition of the structure, the materials used, the presence of safety features like smoke detectors and alarms, and even your personal claims history. Homes in areas with higher crime rates or frequent natural disasters generally face higher premiums. On the other hand, installing safety features or bundling home insurance with auto insurance can reduce costs.

Types of Home Insurance Policies

In the United States, home insurance policies are often grouped into categories known as HO forms. An HO-1 is very basic, covering only a few perils. An HO-2 expands the list. The most popular is the HO-3, which provides broad protection for homes and belongings. HO-4 policies are designed for renters, while HO-5 offers premium protection with wider coverage. Condo owners usually purchase HO-6, mobile homeowners opt for HO-7, and historic or older homes are often insured under HO-8. Each form has unique features, so it is important to select the one that matches your living situation.

Add-Ons and Endorsements

Insurance policies can be customized with endorsements, also known as riders. Common add-ons include flood insurance, earthquake coverage, sewer backup protection, additional coverage for high-value jewelry or art, extended replacement cost coverage, and even identity theft protection. These options make sure your policy reflects your unique needs.

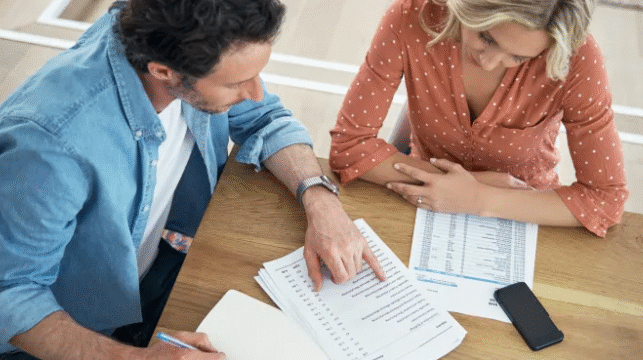

Tips for Choosing the Right Policy

Choosing a home insurance policy requires some planning. First, calculate how much it would cost to rebuild your home and replace your belongings. Next, consider the risks in your area, such as hurricanes, wildfires, or floods. Always compare quotes from several insurers, and do not focus only on the price—coverage details are just as important. Check the financial strength and reputation of the insurer, review the exclusions carefully, and consider bundling home and auto insurance for discounts.

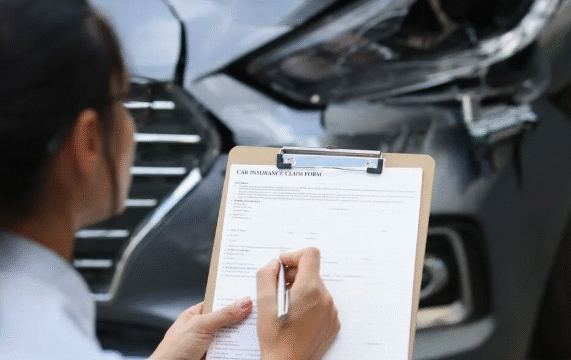

Filing a Claim

If damage occurs, knowing how to file a claim can reduce stress. The process typically starts with contacting your insurance company right away. Document the damage with photos and written descriptions. Make temporary repairs to prevent further harm. Keep receipts for any expenses. An insurance adjuster will then assess the situation and determine payment. Good communication with your insurer helps ensure a smoother claims process.

The Future of Home Insurance

Home insurance is adapting to new technologies and challenges. Smart home devices such as security cameras, leak sensors, and fire alarms are increasingly integrated with policies. They help reduce risks and may lower premiums. At the same time, climate change has led to more severe weather events, which means insurers are reevaluating risks for floods, wildfires, and hurricanes. Digital tools are also making it easier for customers to purchase policies, file claims, and track coverage online.